If for example a British taxpayer who is also a tax resident of Spain since the 2019 exercise and he has assets abroad with a value of over 50000 will have an obligation to present the form 720. Sus objetivos son informar sobre cuentas en entidades financieras valores seguros derechos rentas y bienes inmuebles.

Modelo 720 A Requirement For Uk Expats Holborn Assets Spain Holborn Assets Spain

All You Need to Know about Spains Asset Decleration Form.

Modelo 720 spain 2018. It has been a few years since the Modelo 720 asset declaration form was introduced but it can still slip your mind especially if you have recently moved to Spain. The Modelo 720 is an informative report that any tax resident in Spain who has assets or rights abroad has the obligation to file it. Debo informar de la cancelacin en el modelo 720.

The requirement to submit the Modelo 720 form however is not under challenge. If you do not declare these assets to Hacienda the Spanish tax authorities you. The Modelo 720 form is a basically a declaration of overseas assets for people living in Spain that is to say assets held outside of SpainSpanish tax residents are obliged to fill out this 720 tax form and make the tax authorities Hacienda aware of their fiscal activity in other countries.

The EU commission has given the Spanish authorities 2 months to rectify this otherwise it will take the matter to the EU Court of Justice. No tax will be levied on these assets BUT the records will be used and compared against income tax returns to ensure that income generated from these assets is being reported for example rental income which is typically not. El modelo 720 aprobado en octubre de 2012 como modificacin de la normativa tributaria supone una declaracin informativa sobre bienes y derechos situados en el extranjero.

71 of the fines were due to declarations that were made late. Between January 2019 and the end of March 2019 all residents with assets abroad need to file a tax form called Modelo 720 assets report for residents in Spain over the tax year 2018 from 01012018 to 31122018. The intention is that all fiscal residents of Spain report details of assets held overseas if they exceed certain values.

In general you will be deemed tax resident if you are in livingworking in Spain for more than 183 days a year and remember that the onus is on you the individual to be able to prove otherwise. What is the 720 tax form. Modelo 720 for tax residents in Spain.

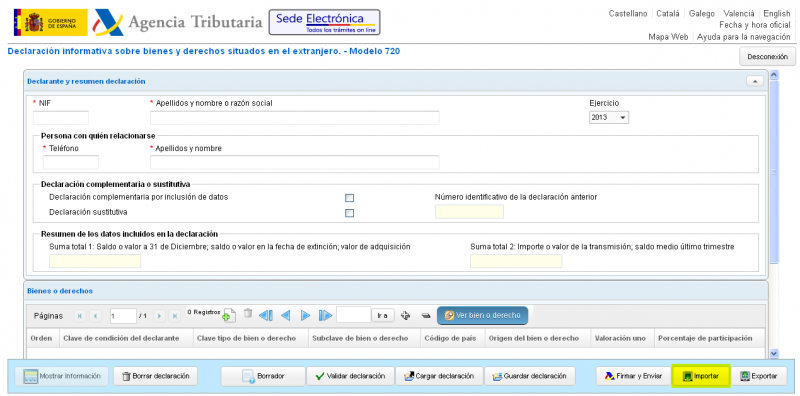

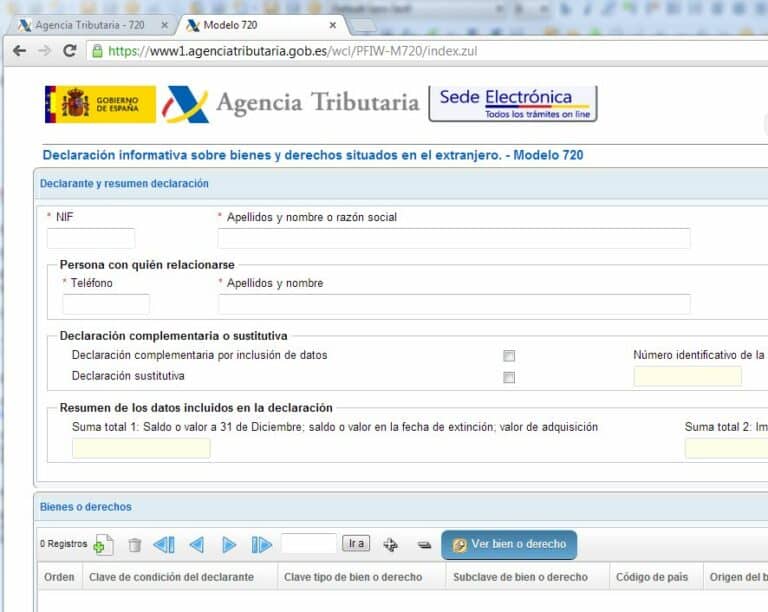

La Ley 72012 de 29 de octubre de modificacin de la normativa tributaria y. En plena campaa de declaraciones de Renta y Patrimonio 2017 son muchsimos los contribuyentes que se estn llevando un. Presentacin hasta 40000 registros Ayuda.

Obligacin modelo 720 en Espaa. If you are deemed to be a tax resident in Spain then this requirement affects you. It is a record of their assets of a specified value and type held in other countries.

Hacienda sigue metiendo miedo con el Modelo 720 con ese arma de destruccin masiva contra el fraude fiscal que es la declaracin informativa sobre bienes y derechos en extranjero establecida en Espaa a finales de 2012. Trmites Informacin y Ayuda Ficha. Although aimed at discovering assets bought by Spanish nationals with irregular money it also affects members of the.

By Antonio Rodriguez Aug 3 2018. La presentacin de la declaracin debe de efectuarse obligatoriamente de manera telemtica. The Modelo 720 was introduced in November 2012.

Bank accounts in financial entities abroad balances incomes insurance and taxes deposited managed or obtained abroad real estate and any profits coming from real estate outside of Spain Do I need a Form 720. 1st February 2018. Declaracin sobre bienes y derechos situados en el extranjero.

Lets break down this process which can seem complicated but is in fact fairly. Concretamente referente a la declaracin del ao 2018 el plazo voluntario de la declaracin comenzar el 1 de enero de 2019 y finalizar el 31 de marzo de 2019. PREGUNTAS FRECUENTES DEL MODELO 720 ENERO 2018 PREGUNTAS FRECUENTES M720 8 PREGUNTAS FRECUENTES Relativas a la.

Si cancelo la cuenta el 8 de abril de 2013 cuando tena un saldo de 5624675. Form 720 in Spanish Modelo 720 is a declaration of overseas assets held outside of Spain. The Modelo 720 reporting requirement is based on tax residency.

This includes details about. Madrid Modelo 720 Spain This article is published on. In 2013 the Spanish Government launched an anti-fraud plan to prevent tax evasion.

El saldo a 31 de diciembre es de 45650 y el saldo medio del ltimo trimestre es de 4620045. Form 720 should be submitted telematically from the 1st of January to the 31st of March of every year. Debo declarar la cuenta en el modelo 720.

Secondly on the 31 May 2017 all EU countries plus the UK and. In simple terms the Modelo 720 form is a declaration of overseas assets that Spanish tax residents are obliged to fill out. Que tributarn en Espaa por su renta mundial es decir por la integridad de su renta.

So far the Spanish tax authority has issued fines to 5000 taxpayers since the inception of the modelo 720 in 2013 although the majority of these fines were issued in 2015 4321 fines. This modelo 720 is in place since January 2013 reporting over the year 2012 this Modelo. In 2019 only 6 fines were issued.

By Chris Webb - Topics. Modelo 720 WHATS IT ALL ABOUT. In case you are one of the people that is not aware of this important form the 720 is a form which some foreigners living in Spain have to complete.

Model 720 Declaration On Assets And Rights Located Abroad Ar Lawyers

Murcia Today How Automatic Exchange Of Information And The Modelo 720 Could Effect You Blacktower Financial Management

What Impact Does The 720 Modelo Have On My Pension Harrison Brook

Assets Reporting Modelo 720 The One Stop Problem Shop

Tax Form 720 Spain Avoiding Penalties Advocate Abroad

Modelo 720 A Requirement For Uk Expats Holborn Assets Spain Holborn Assets Spain

European Court Of Justice S Lead Council States Spanish Tax Form 720 Fines Are Disproportionate

Reporting Assets Outside Spain Form 720 Javier Ullastres Asesores

The Modelo 720 Declaration Things To Look Out For Axis Finance Com

Modelo 720 A Requirement For Uk Expats Holborn Assets Spain Holborn Assets Spain

Modelo 720 In Spain Taxadora Com Spanish Taxes Explained

Model 720 In Spain Complete Guide How To Do Your Asset Declaration

Form 720 Spain Declaration Of Assets Abroad Ilia Consulting

Formulier 720 Modelo 720 Idealista

Tax Residents In Spain Tax Form 720 Declaration Of Assets Abroad Illegal

Modelo 720 Archives The Spectrum Ifa Group

Presentacion Electronica Del Modelo 720 Agencia Tributaria

Form 720 The Tax Agency Requires That Residents In Spain Declare Assets That Are Not Located In Spanish